Measuring the true employee cost for employers has always been a challenge. Much of the criteria considered are subjective and each component carries varied significance depending on who is doing the measuring. Conversely, analyzing objective data shows a clearer picture of measurable employee cost, which is the focus of this post.

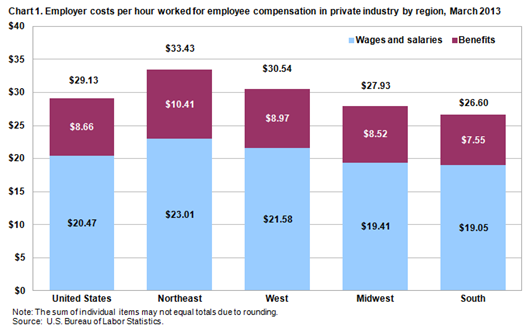

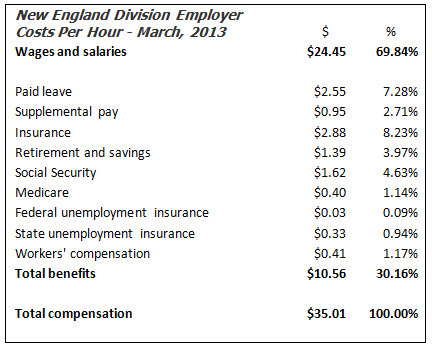

In a March, 2013 report issued by the United States Department of Labor Bureau of Labor Statistics (DOL), the total average hourly cost for an employee (including benefits) in private industry nationwide was $29.13. In New England (which is a subset of the Northeast region), employee costs were highest at $35.01 with $10.56 (30.2%) of the total spent on benefits, which include insurance, legally required benefits, paid leave, and other costs.

All of these benefits are managed or administered by Human Resource Departments. Given that such a high percentage of employee costs are managed by HR, it is important to understand the impact effective human resource management has on benefits. Some costs listed (Social Security, Medicare, and Federal Unemployment Insurance) are federally mandated and do not vary from state to state. Other expenses can be significantly impacted by human resource management.

The chart below uses data from the DOL report for the New England Division, which is a subset of the Northeast Region.

Source: United States Department of Labor Bureau of Labor Statistics

Insurance

Human Resource Managers who navigate through the complexities of health insurance can help control costs by understanding risk, influencing plan design, and implementing effective wellness programs. Other insurance (life and disability, as an example) make up part of the 8.23% of wage costs in New England. Having HR Managers who have a full understanding of the entire employee benefit offering is critical.

State Unemployment Insurance

In every state, mandated state unemployment insurance is calculated on a claims based formula. Effective human resource management can help keep retention high and minimize the effect of a high unemployment rate, which could amount to a difference of several hundred dollars annually for each employee.

Workers’ Compensation

An effective risk management policy can help control costs, especially for those businesses whose workers are subject to an increased risk of injury based on their job function. Assisting insurance carriers by managing claims internally, monitoring modification rates, and managing effective back-to-work initiatives are critical to help contain costs.

While the majority of employee costs are fixed, the strategies above demonstrate the importance of human resource management in controlling insurance, state unemployment insurance, and workers’ compensation costs. If you are not already measuring these cost components, now is the time to start.