If you’re considering partnering with a PEO, the question that’s inevitably on your mind is this:

How much does a PEO cost?

Here’s the truth: It really depends on your business and your needs. In this article, we’ll look at all the factors that contribute to PEO pricing, and compare the options you have with regard to the relative costs of outsourcing vs. doing HR work yourself.

What factors determine PEO prices?

Following are the two primary factors that determine pricing:

- Level of engagement—Your business might only require a basic engagement with a PEO, meaning payroll and benefits administration. If your business needs more one-on-one attention from HR experts, that will be more of an engagement, and investment. This enhanced level of service gives your company access to an experienced team that can help navigate difficult employee situations, and provide training and coaching to staff managers, either on-site or virtually.

- Technology—The other factor that’s becoming increasingly relevant is technology. Basic tech tools come with every PEO solution, and may include modules for timekeeping and applicant tracking. More expensive technology platforms offer learning management systems (LMS) that provide online training, resource libraries, training tools for delivering an effective presentation, business writing, safety classes, etc.

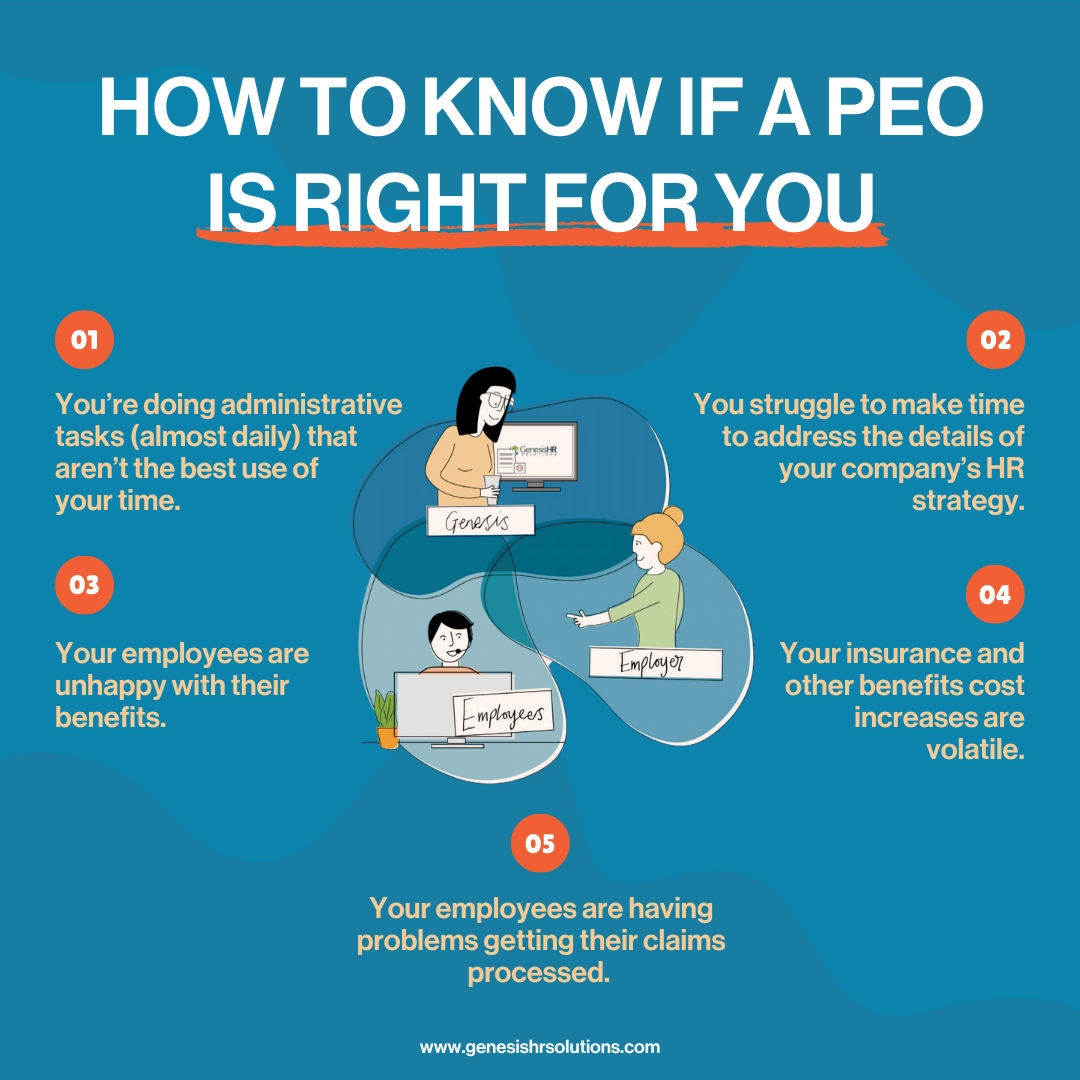

How do you know if a PEO is right for you?

For the answer to this question, ask yourself if any of these situations sound familiar:

- You’re doing administrative tasks (almost daily) that aren’t the best use of your time.

- You worry about compliance requirements slipping through the cracks.

- You struggle to make time to address the details of your company’s HR strategy.

- You don’t know if the benefits you’re offering are attractive to prospective employees.

- Your employees are unhappy with their benefits.

- Your employees are having problems getting their claims processed.

- Your insurance and other benefits cost increases are volatile.

If you’re experiencing any of the above, you’re likely a good candidate to partner with a PEO. Each of these situations is a sign that you may be falling short in important matters associated with HR, benefits, and compliance issues (not to mention you’re doing tasks that aren’t a good use of your time). These scenarios are exactly why PEOs like GenesisHR exist.

Find out if a PEO partnership with GenesisHR could change your business for the better. Schedule a free, no-obligation consultation now.

Should you hire someone internally or outsource to a PEO?

As your business grows, you’ll likely find you’re spending more time dealing with complexities of HR administration that are not within your area of expertise. You know you need help, but how do you know whether to hire someone internally to handle your HR issues, or, as an alternative, partner with a PEO?

Based on our experience, it all comes down to comparing the costs of what you would pay to hire a full-time HR manager or PEO, as well as comparing the value each option brings to the table. Consider the questions that follow to help flesh out the comparison.

Do you need tactical support or strategic guidance?

Do you have tactical needs, like onboarding, recruiting, handling personnel files, and reviewing compliance? Or do you have strategic needs, like digesting new legislation, or understanding and implementing compliance and regulatory requirements, or professional development and succession planning ?

What roles will your PEO or new hire need to fulfill?

- Writing job descriptions

- Interview planning and candidate profiling

- Background checks

- Onboarding new employees

- Setting up direct deposit

- Completing compliance forms

- Selecting taxes and benefits enrollment

- 401(k) enrollment

- Document management

- Training

- Benefits administration

- Annual renewals of insurance including: medical, dental, vision, life, disability, worker’s compensation

- Annual enrollment

- Providing employee education about benefits

- Providing customer service around benefits, including answering questions around life events and qualifications and service around claims

- COBRA administration

- Federal and state payroll and payroll tax administration on behalf of both employee and employer

- Creation and implementation of employee handbook and workplace policies

- Compliance

- Overseeing state and federal legislation and regulations

- Monitoring sick leave laws

- Monitoring employee classification regulations

- Monitoring wage and hour laws

- Monitoring equal opportunity and non-discrimination/non-harassment requirements

- Monitoring employee eligibility

- Monitoring family medical leave regulations

- Managing employee records

- Managing unemployment claims

- Managing equal pay

Can a single in-house hire provide the same level of expertise in all areas as a PEO?

The answer to this question, realistically, is no. No single person can take care of all of the things listed above; you’d have to hire multiple individuals (including attorneys) specifically for the compliance angle alone.

With GenesisHR as your PEO, you get a multitude of experts in one partnership, for a single price. Our internal team can assist you in all areas: payroll experts, benefits specialists, risk managers, trainers, and more.

Even more importantly, you get their knowledge and expertise in all these areas exactly when you need it. The availability of our experts doesn’t cost you money, but they are standing by whenever you need them. These services are layered on top of a technology platform that provides an easy payroll and reporting tool.

You get knowledge and expertise of our experts exactly when you need it. Their availability doesn’t cost you money, but they are standing by whenever you need them. Share on XCost Comparison: An In-house Hire Vs. Outsourcing To A PEO

| In-House Hire | PEO | |

|---|---|---|

| Salary | X | |

| Employer taxes | X | |

| Providing equipment and office space | X | |

| Licenses (if applicable) | X | |

| Technology platform | X | |

| Payroll service | X | |

| Cost of consultants, attorneys, specialists to handle issues they may not be familiar with | X |

How does the cost compare?

If you’re a company of 40 employees and you want to hire a mid-range HR professional, you’re looking at an approximate $85,000 annual salary plus additional expenses, including a fee for a payroll service (approximately $5,000 annually).

With a PEO, your 40-employee organization may pay $50,000 for a PEO partnership that can handle all types of HR services, including payroll.

Of course, the cost comparison will vary based on the engagement level of your PEO and the number of employees your business has.

Understanding PEO Fees

If you choose to partner with a PEO, make sure they walk you through what you’re paying. PEOs generally charge a fee for their services, paid either as:

- a flat fee (per employee per year amount) or

- a percent of payroll (percentage of the employer’s total wages)

GenesisHR works differently than some PEOs, who bundle their fees with things like SUTA and worker’s comp insurance, making it harder for you to understand what you’re really paying for the services.

At GenesisHR, we only charge a flat PEO fee. We want our clients to know exactly what they’re paying and the value they get from their payment. Additionally, with a percent of payroll fee, every time your business does a pay raise, etc., you’re paying more to your PEO. With our flat fee schedule, you pay the same amount—with no hidden fees, ever.

Find out more about the kind of service you’ll only get with GenesisHR Solutions.

What we started in 1991 for SMBs in New England has grown into a full-service PEO for companies everywhere, of all sizes. Let us help you evaluate your current situation, discuss our PEO fee, and show you how a PEO partnership benefits businesses like yours.