The I-9 Form is one of the most commonly filled out employment forms. Every new hire, at every business in the US SHOULD have filled one out the day they started, and their employer SHOULD have them properly filed. I stress the word SHOULD, because we see an alarming number of companies that do not have their I-9 Forms filled out or filed properly. If audited, a business faces a penalty per I-9 Form that is not properly filled out and filed. These penalty amounts can add up quickly. Why not take a little extra time to avoid these potential penalties? Here’s how:

The Form I-9 is used to verify the identity and employment authorization of individuals hired for employment in the United States.

- All U.S. employers must ensure proper completion of the Form I-9 for each individual that they hire for employment. This includes both citizens and noncitizens.

- Both employees and employers (or authorized representatives of the employer) must complete the form.

- On the form, an employee must attest to his or her employment authorization. The employee must also present his or her employer with acceptable documents verifying identity and employment authorization.

- The employer must examine the employment eligibility and identity document(s) an employee presents to determine whether the document(s) reasonably appear to be genuine, if they pertain to the employee and record the document information on the Form I-9. The list of acceptable documents can be found on the last page of the Form I-9.

Employers must retain an employee’s completed Form I-9 for as long as the employee works for the employer. Once the individual’s employment has terminated, the employer must retain the Form I-9 for either three years after the date of hire, or one year after the date employment is terminated, whichever is later.

Section 1 on Form I-9

When completing the Form I-9, you must make available to your employee the complete instructions to the form and the List of Acceptable Documents. Your newly hired employee must complete and sign Section 1 of Form I-9 no later than their first day of employment.

You may have your employee complete the Form I-9:

- On their first day of employment

- Before their first day of hire, if you have offered the individual a job and if they have accepted the offer.

Section 2 on Form I-9

Before completing section 2, employers must make sure that Section 1 is completed properly and on time. Employers may not ask an individual to complete Section 1 before he or she has accepted a job offer.

Completing Section 2, Employer Review and Verification:

Employers must complete and sign Section 2 of the Form I-9 within three business days of the date of hire of their employee (the hire date means the first day of work for pay). For example, if your employee began work for pay on Monday, you must complete Section 2 by Thursday of that week. If the employment lasts less than three days, you must complete Section 2 no later than the first day of work for pay.

Employees must present unexpired original documentation that shows the employer their identity and employment authorization. Your employees choose which documentation to present.

Employees must present:

- One selection from List A or

- One selection from List B in combination with one selection from List C.

An employer or an authorized representative of the employer completes Section 2. Employers or their authorized representatives must physically examine the documentation presented and sign the form.

Section 2 includes two spaces that require dates. These spaces are for:

- Your employee’s first day of employment (i.e., “date of hire” which means the commencement of employment of an employee for wages or other remuneration).

- The date you examined the documentation your employee presented to show identity and employment authorization.

The Date the Employee Began Employment

The date your employee began employment may be a current, past or future date. You should enter:

A current date

o If Section 2 is completed the same day your employee begins employment for wages or other remuneration

A past date

o If Section 2 is completed after your employee began employment for wages or other remuneration. Enter the actual date your employee began employment for wages or other remuneration.

A future date

o If Section 2 is completed after the employee accepts the job offer but before he or she will begin employment for wages or other remuneration, enter the date

the employee expects to begin such employment. If the employee begins employment on a different date, cross out the expected start date and write in the correct start date. Date and initial the correction.

The Date the Employer Examined the Employee’s Documents

This date is the actual date you complete Section 2 by examining the documentation your employee presents and signing the certification.

Section 3 on Form I-9

To be completed and signed by the employer or authorized representative. Section 3 includes three spaces to enter dates

- When rehiring a former employee, if it is within 3 years of the date the Form I-9 was originally completed, enter the rehire date that your employee begins employment for wages or other remuneration, which can be a future date, if necessary, in Block B.

- If you re-verify your employee: Enter the date the employee’s current work authorization document expires in Block C.

- When completing Section 3 for any reason: Enter the date you complete and sign the attestation.

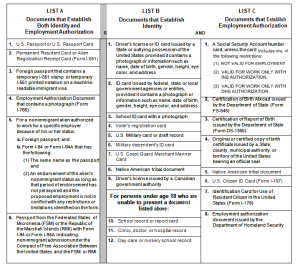

LISTS OF ACCEPTABLE DOCUMENTS All documents must be UNEXPIRED

Employees may present one selection from List A or a combination of one selection from List B and one selection from List C.

Illustrations of many of these documents appear in Part 8 of the Handbook for Employers (M-274).

Illustrations of many of these documents appear in Part 8 of the Handbook for Employers (M-274).

A frequent question many employers may have. May I fire an employee who fails to produce the required documents within three business days of his or her start date? A) Yes. You may terminate an employee who fails to produce the required document or documents. Or an acceptable receipt for a document, within three business days of the date employment begins.

To obtain forms and updates or a copy of the Guidance for Completing Form I-9

Handbook for Employers call USCIS Forms Request Line at 1-800-870-3676

If you have questions or would like to learn more, please reach out to Genesis HR Solutions at AskUs@genesishrsolutions.com or 800-367-8367.

Genesis HR Solutions is the premier PEO provider for Massachusetts based businesses.