When choosing a professional employer organization (PEO), there is an entire checklist of items you should consider to make sure you choose a partner that is a good fit for you. In this article, we’re honing in on one of the most important aspects of working with a PEO—the tax perspective.

You know partnering with a PEO is the right move—now, here’s how to find the best match for your business.

Download the free checklist: Picking The Right PEO Company For Your Business

Not realizing the importance of details related to finances, payroll, and taxes presents one of the biggest risks for growing companies. This innocent lack of knowledge puts business owners in jeopardy if (or when) they make mistakes. One company that we recently onboarded had employees in 12 states but was only set up for employment taxes in 7. We set up the appropriate accounts and worked with them to resolve the outstanding tax issues. Another company had recently set up a 401k plan but they did not understand their fiduciary responsibilities. Not only did they fail to provide the necessary enrollment information to their employees but when they resolved that, they did not remit the contributions in a timely fashion. The consequences of that could have put them out of business…

At GenesisHR, our ESAC accreditation and CPEO certification means that, when you come on board as our partner, we take on the majority of the fiduciary responsibility for your employees. Few business owners realize the scope of their fiduciary responsibilities—many of our new clients are shocked to realize how much risk they were exposing themselves to. When you partner with us, we set you up correctly and help you implement best practices for all things tax- and finance-based—as well as other HR aspects.

PEO vs. CPEO: What’s the difference?

A professional employer organization (PEO) allows its clients to outsource many of their human resource functions, share employment liability, and, oftentimes, gain economies of scale to bring an improved benefits package to their employees. In a PEO agreement, PEOs and their clients sign a co-employment agreement in which both the PEO and client company have an employment relationship with the worker. The PEO and client company share and allocate responsibilities and liabilities.

A Certified PEO (CPEO) acts the same as a “regular” PEO but has some additional benefits for small and midsize businesses. The IRS definition of a CPEO is as follows:

The IRS established a voluntary certification program for professional employer organizations (PEOs). These organizations typically handle various payroll administration and tax reporting responsibilities for their business clients.

Certification affects the employment tax liabilities of both the CPEO and its clients. A CPEO is generally treated as the administrative employer of record for individuals performing services for a client of the CPEO and covered by a CPEO contract between the CPEO with the client, but only for wages and other compensation paid to the individuals by the CPEO.

Learn More: What is a Certified Professional Employer Organization (CPEO)?

To become and remain certified by the IRS, CPEOs must meet certain requirements with regard to tax compliance, financial stability and controlling persons ethics. Certified PEOs take on additional responsibilities with regard to payroll administration and federal employment tax reporting and payments of their clients.

Of the approximately 500 PEOs in the U.S., only about 50 have achieved certified PEO status.

CPEO IRS designation is a voluntary program for outstanding PEOs (like GenesisHR!). Only a small percentage of PEOs reach CPEO certification—according to NAPEO, of the approximately 500 PEOs in the U.S., only about 50 are certified.

Tax/Financial Differences Between Working With A PEO Vs. A CPEO

| Certified PEO | PEO | |

| IRS certification/renewal verification required | x | |

| Required quarterly proof of payment/review to ensure taxes are paid | x | |

| Less financial/tax-related exposure to risk | x | |

| Shared Risk | x | x |

| Bonding Requirement | x | |

| Some Wage Base Elimination | x | |

| Eligible for tax credits | x | x |

| Annual Audit Required | x |

One important thing to note that’s not indicated in this chart—there’s no difference in cost between hiring a PEO vs. a CPEO! Clients sometimes ask us how much more we charge as a certified PEO, and we’re happy to say there is no upcharge for this very value-added benefit!

The Next Level: ESAC CPEOs

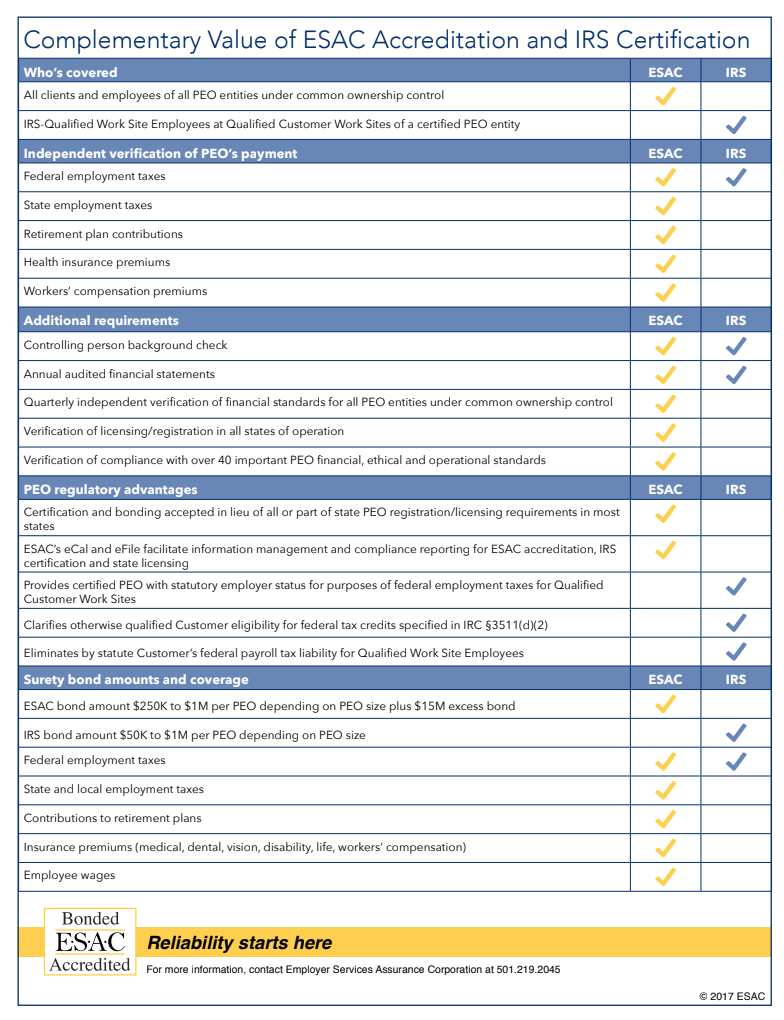

Employer Services Assurance Corporation (ESAC) accreditation is the next level of certification beyond CPEO/IRS certification. ESAC is an independent nonprofit corporation that is the official accreditation and financial assurance organization for the PEO industry.

ESAC accreditation is the Gold Standard for PEO best practices and financial reliability. Only about nine percent of PEOs have earned this distinction. Accreditation provides business owners, PEOs, and PEO state/federal regulators with time-tested verification and financial assurance of all key areas of PEO reliability for both IRS-certified and non-certified entities.

If you are looking for a PEO with proven expertise in financial and tax knowledge, you need to look for an ESAC Accredited PEO. (Just ask, or, if you’re browsing websites, look for the handy little seal—at GenesisHR, ours is proudly displayed at the bottom of our website!)

Below is a chart of the complementary values of ESAC accreditation and IRS certification.

GenesisHR ESAC: Above & Beyond Your Typical PEO—and CPEO

At GenesisHR, we’ve been experts in finance, tax, and HR administration for decades. Even before ESAC existed—and before CPEO certification existed—we advocated for stringent standards to be set for PEOs to make sure they were taking financial care of their clients. In doing this, we identified the risks to employers from a tax standpoint, and helped our legislative leaders identify PEO oversight needs. This was a precursor to what would become ESAC accreditation.

When ESAC accreditation became available, GenesisHR was the 13th accredited PEO in the country, and we’ve been consistently accredited since May of 1996.

Let’s schedule a free discovery call now to talk about how GenesisHR Solutions can help relieve you of the burden of tax administration, payroll, and finance.