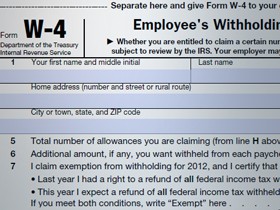

Most employers believe that once they collect a W-4 form from a new employee they can simply file it away. This is not always the case. There are some instances when an employer needs to collect a new W-4 form from their employees.

Most employers believe that once they collect a W-4 form from a new employee they can simply file it away. This is not always the case. There are some instances when an employer needs to collect a new W-4 form from their employees.

A Form W-4 remains in effect until an employee submits a new one except when an employee claims to be exempt from income tax withholding or you as the employer receives a lock-in letter from the Internal Revenue Service.

Employees claiming exemption from withholding:

To continue to be exempt from withholding in the next tax calendar year, employees must give employers a new W-4 claiming exempt status by Feb. 15 of that year. If an employee fails to give you a new properly completed Form W-4 claiming exempt, you should withhold federal income taxes from their wages as if he or she were single and claiming no withholding allowances. For more information on this topic, click here.

IRS Lock-in-Letters:

If the IRS finds a significant problem with under-withholding of taxes for a particular employee, they may issue a notice which is referred to as a “Lock-in-Letter” to you as the employer. The lock-in-letter will specify the withholding rate and maximum number of withholding allowances permitted for the employee for purposes of calculating the required withholding tax.

Once the lock-in letter takes effect, the employer must disregard any Form W-4 that results in less tax withheld, until the IRS notifies you otherwise. However, if you receive a Form W-4 that results in more income tax withheld than the withholding rate and withholding allowances specified in the lock-in letter, it must be honored. The lock-in letter provisions apply to employees rehired within 12 months from the date of the original notice.

Employer Requirements:

Employers are required to remind employees before Dec. 1 each year to submit a new W-4 form if their withholding allowances have changed or will change for the upcoming year.

Timely Reminders:

With the tax filing season just behind us, many employees may want to change the number of withholding allowances or the marital status claimed on their Form W-4 for a number of reasons. Although employers are not required, this would be the ideal time to remind employees how to make a change to their W-4. You can download and print a current Form W-4 from the IRS website at www.irs.gov.

If you have any questions or would like to learn more about employees claiming exemption from withholding, please reach out to Genesis HR Solutions at AskUs@genesishrsolutions.com or 800-367-8367.

Genesis HR Solutions is the premier PEO provider for Massachusetts based businesses.