Employers must furnish W-2 statements to employees no later than January 31 of each calendar year. Imagine if throughout the year your payroll wages were reconciled at the end of each quarter, employees have been asked to verify their name and social security number, and all year-end adjustments have been processed. Wouldn’t it be great to send out W-2(s) the first week in January? Just think of the boost it would have on employee morale.

Employers must furnish W-2 statements to employees no later than January 31 of each calendar year. Imagine if throughout the year your payroll wages were reconciled at the end of each quarter, employees have been asked to verify their name and social security number, and all year-end adjustments have been processed. Wouldn’t it be great to send out W-2(s) the first week in January? Just think of the boost it would have on employee morale.

However, if you offer a Health Savings Account (HSA) to your employees you may want to make sure that you allow enough time for the HSA plan administrator to process your last contribution file for the year. Although the best way to fund a HSA account is through payroll deductions, participants are allowed to make deposits directly to their account with post-tax dollars. This happens more often than you think. The participant can still save on taxes by claiming a deduction when they file their personal tax return. When this happens employers have no knowledge of the transaction unless the combined total exceeds the contribution limit for the year. Should you receive notification from your plan administrator that an employee has exceeded the maximum amount allowed after W-2(s) have been generated, you will need to issue a corrected W-2 to the employee.

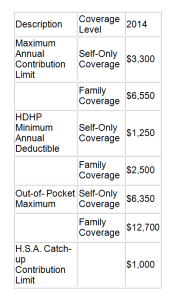

The maximum contribution limit is the maximum amount of pre-tax contributions you can make to your H.S.A. account each year. The Internal Revenue Service sets limits for the Health Savings Accounts (HSA) and qualified High Deductible Health Plans (HDHPs) based on individual and family coverage. If you exceed this amount, you have until the tax-filing deadline, the following April, to remove the excess funds. Excess funds that are not removed by the tax-filing deadline are subject to tax penalties.

Catch-up contributions of an additional $1,000 are allowed for HSA account-holders who are age 55 or older and are NOT enrolled in Medicare.

In order to be eligible to open an HSA, you must be enrolled in a high-deductible heath plan.

The 2014 Health Savings Account (HSA) contribution limits, out-of-pocket maximums and high deductible health plan (HDHP) deductibles are listed below:

Reach out to your Health Savings Account Plan Administrator before selecting the print option on your W-2(s)!

If you would like more information on why you should wait on processing W-2’s if you have an HSA, please reach out to Genesis HR Solutions at AskUs@genesishrsolutions.com or 800-367-8367.

Genesis HR Solutions is the premier PEO provider for Massachusetts based businesses.